Contents:

Each of the rules below is important, but when they work together the effects are strong. Keeping them in mind can greatly increase your odds of succeeding in the markets. Controlling emotions while trading can prove to be the difference between success and failure. Trading Discipline is hard because of something I call the shiny object syndrome.

India VIX at Multi-Year Low; How to Trade Options? — Investing.com India

India VIX at Multi-Year Low; How to Trade Options?.

Posted: Wed, 26 Apr 2023 12:40:26 GMT [source]

Other traders may win 60% or 70% of their trades, but their wins may be equivalent to, or only slightly larger than, their losses. Daily profits can still occur despite those losses, but only if the losing trades don’t discourage you. If losing trades cause you to lose focus, you’re more likely to miss the next trade, which could be a winner. As discussed above, day trading requires a lot of waiting. The bottom line, though, is that your actual trading time is minuscule each day, even if you’re an active day trader.

Consistency and Discipline Go Hand in Hand

In fact, some view technical analysis as simply the study of supply and demand forces as reflected in the market price movements of a security. Professional analysts often use technical analysis in conjunction with other forms of research. A trader might receive a good fundamental and technical knowledge and is ready to move in the world of capital markets.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Whatever is wrong in your life will eventually carry over into your trading performance. This is especially dangerous if you haven’t made peace with money, wealth, and the magnetic polarity of abundance and scarcity. Keep your trading needs separate from your personal needs, and take care of both.

- Financial markets range from common equity to options on futures.

- Setting realistic goals is an essential part of keeping trading in perspective.

- Some of us are prone to certain weaknesses, but we can offset them with strengths, which can help us mitigate the damage caused by our weaker qualities.

- For instance, you might realize that you usually ignore your exit rules.

- Independence is just developing a trading style that works for you .

This includes stocks,futures,commodities, fixed-income, currencies, and other securities. In fact, technical analysis is far more prevalent in commodities andforexmarkets wheretradersfocus on short-term price movements. The best method of having discipline in trading forex is to manage risk effectively by using stop-loss orders and position sizing based on your account size.

One implements proven trading strategies, over and over, so that across a series of trades, the strategies work enough to produce an overall profit. It’s like making shot after shot on the basketball court so as to accumulate a winning number of points. The more shots you take, the more likely you will amass points. But the winning player is the person who first develops the skill to make the shot consistently so that at every possible opportunity, the ball is likely to go through the basket.

capital markets accountingtools your trading plan, and reinforce the idea that if you follow your plan, you will end up more profitable in the long run. Business Of Sports If the only thing you know about sports is who wins and who loses, you are missing the highest stakes action of all. The business owners that power this multibillion dollar industry are changing, and a new era of the business of sports is underway.

The Importance of Trading Psychology

Keep in mind that the guru might be talking up their own positions, hoping the excited chatter will increase their profits, not yours. Ryan Eichler holds a B.S.B.A with a concentration in Finance from Boston University. He has held positions in, and has deep experience with, expense auditing, personal finance, real estate, as well as fact checking & editing. Probably one of the hardest things in trading is that it takes time to master. Or you will be one of the traders complaining you need more money to reach your goals.

From the previous example, if the traders call for that period gets right and the market goes to 103, the trader should book his profit. This is why I tried my best to avoid trading tips like “stick to your stop-losses” and “don’t let a winner become a loser”. These tips paraphrase roughly to “be disciplined and follow your trading plan”. Position size is the primary determinant of the outcome of any trading strategy.

Rising prices for fuels and metals seem to have made trickery all the more appealing. Such disputes are becoming painfully common in the industry responsible for ferrying food, fuel and metals around the world. Last year traders stopped supplying a Chinese metals merchant after $500m-worth of copper went AWOL. In February Trafigura, a trading giant, booked $600m in losses after discovering that cargoes of nickel it had bought were in fact worthless stones. Last month the London Metals Exchange found bags of stone instead of nickel at one of its warehouses. When it comes to emotions, all of us as traders struggle in this department at one point or another.

Business & economics

This constant difference poses a problem when someone only looks at textbook examples of a strategy. When they go to implement it, everything looks different from how it did in the example. Maybe there is more volatility, less volatility, a stronger trend, or a range. They simply haven’t developed their patience enough to wait for the great entry and exit. This trait goes hand-in-hand with discipline, and you need to be patient until there is a call to action.

Develop the discipline and objectivity you need to be a successful trader with our tips on managing powerful emotions such as fear and greed. This section also explains how to improve your approach to trade more consistently. Trading Discipline is allusive to many traders but not you, if you apply the tips I teach you in this article.

Emotional Discipline Equals Trading Discipline

Financial analysis is the process of assessing specific entities to determine their suitability for investment. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

If the player uses one approach one time, and a different approach at another time, performance is haphazard. One must trade consistently, following a specific trading plan on each and every single trade. This allows the law of averages to work in your favour so that across the series of trades, you will make an overall profit. If you follow the plan sometimes and abandon it at other times, you throw off the probabilities, and you are likely to end up losing overall. With my rules, I know exactly where my entries and exits will take place, and I know exactly when I’ll cut the trade for a loss. There’s no mystery, and I don’t have to rely on my emotions to make these decisions.

The most important skill in trading is to develop trading discipline today, I am going to help you a trading discipline master. By the end of this article you will know exactly what you need to do to become a master at discipline. Unlike manufactured goods, such as cars or smartphones, common raw materials are priced according to public benchmarks.

If your interested in joining one of our groups let me know in the comments below. If you are willing to do the work, it will yield a harvest that will feed you and your family forever. This is a plot of ground that is yielding nothing and is costing time and money to maintain. Trading Discipline falls under the category of Market Psychology which is critical to trading success.

Adjust your mindset and understand that discipline extends to all areas of our lives. If you’re switching between your charts and chat rooms, you cannot maintain focus. You need to be at least somewhat disciplined in the first place to follow the usual advice. Traders need to become experts in the stocks and industries that interest them. Keep on top of the news, educate yourself and, iif possible, go to trading seminars and attend conferences.

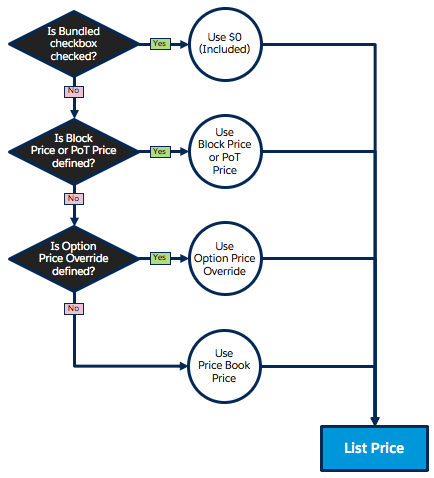

https://1investing.in/ discipline refers to the ability of traders to adhere to a set of rules and principles consistently. It involves controlling emotions, such as fear and greed, and following a well-defined trading plan that includes risk management strategies. Trading discipline is crucial for successful trading because it helps traders to avoid making impulsive decisions, which often lead to losses. By sticking to a plan and following a set of rules, traders can minimize risks and increase the likelihood of making profitable trades.

A stop loss is a predetermined amount of risk that a trader is willing to accept with each trade. The stop loss can be a dollar amount or percentage, but either way, it limits the trader’s exposure during a trade. Using a stop loss can take some of the stress out of trading since we know that we will only lose X amount on any given trade. Before you start using real cash, make sure that all of the money in that trading account is truly expendable. World politics, news events, economic trends—even the weather—all have an impact on the markets. The more traders understand the past and current markets, the better prepared they are to face the future.

WGA Tells Members to Get Ready to Picket If a Deal Isn’t Reached — Hollywood Reporter

WGA Tells Members to Get Ready to Picket If a Deal Isn’t Reached.

Posted: Mon, 01 May 2023 02:26:18 GMT [source]

Rushing into a trade too quickly before you get a confirmation from price action might cost you dearly. Because the next time I decide to rush and buy or sell into another trade, I will remember this “missed opportunity”. I did not listen to others including the price action signal that the market was giving me. If I find myself unable to feel the market, I will go down to one trade per day.

With that being said, these emotions tend to stay under control when we’re working from a rules-based approach. While they use data from the past to help them make trading decisions, they must be able to apply that knowledge in real-time. Like chess masters, traders are always planning their next moves, calculating what they will do based on what their opponent does.

Knowing the difference between common trading myths and reality is essential to long-term success. Regardless of your trading preferences, discipline will remain important. With a solid foundation of trading fundamentals, you will be able to achieve your long-term trading objectives.

My role is to simply focus on nothing but the strategy, so I can keep the consistency going. As mentioned, new traders tend to struggle because they’re all over the place with the setups they trade, the strategies they deploy, and the indicators they rely on. This “flavor of the week” mentality doesn’t lead to the trading consistency we’re all after. You can trade thousands of different stocks at every second of the day, yet very few of those seconds provide great trading opportunities.

By documenting this on a daily basis, you will begin to better understand your emotions and how these are impacting the management of your trade. Look through your trades to see what your average gains and losses are per trade. You can use about a month worth of data to come up with a good figure. It’s about placing the right trades every day and trusting the process. Make no mistake about it, the process is what is going to make you successful. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading.