Later that day, you get an urgent text from your bank that your account is overdrawn by $5,000. If you had performed regular bank reconciliations, you would have known about that check and to keep your eyes peeled for it. Reconciliation can help you monitor your cashflow so you have enough to cover your business needs.

We empower companies of all sizes across all industries to improve the integrity of their financial reporting, achieve efficiencies and enhance real-time visibility into their operations. More than 4,200 companies of all sizes, across all industries, trust BlackLine to help them modernize their financial close, accounts receivable, and intercompany accounting processes. Working capital, cash flows, collections opportunities, and other critical metrics depend on timely and accurate processes. Ensure services revenue has been accurately recorded and related payments are reflected properly on the balance sheet. Account reconciliation is useful to external auditors, who require the process and review records when assessing a public company’s internal controls environment, as set forth by the Sarbanes-Oxley Act of 2002.

The account reconciliation process keeps your business on track with its finances and different regulatory requirements. You might want to know where your money is going, how much you have left, and what to do with it. In the bank books, the deposits are recorded on the credit side while the withdrawals are recorded on the debit side.

Documentation review

We’ve all heard of small businesses that lose tens of thousands, even hundreds of thousands, to embezzlement. Many of those thefts could have been halted in their tracks immediately if the bank accounts had been reconciled regularly. When an account is reconciled, the statement’s transactions should match the account holder’s records. For a checking account, it is important to factor in any outstanding checks or pending deposits.

- However, the depositor/customer/company credits its Cash account to decrease its checking account balance.

- The Versapay Collaborative AR Network is the first solution that empowers the genius of teams by bridging the gap between suppliers and buyers through a shared, digital experience.

- Leadership expert Stephen Covey’s adage, “begin with the end in mind,” isn’t just sage advice for individuals.

- You should prepare a bank reconciliation statement that explains the difference between the company’s internal records and the bank account.

- Small and large businesses frequently need more time to receive complete vendor and bank statements.

- It is essential to do this when multiple accounts exist for the same transaction.

Some of the transactions affected may include ATM service charges, check printing fees. Once your bank accounts and payment and e-commerce platforms are connected to your accounting software, your bank balance will be regularly updated. Individual transactions and payouts will also be regularly synchronized with your accounting in the background. It’s time to double-check your ledger and all the discrepancies that were noted. If discrepancies have been detected in the previous step of account reconciliation, balance errors should be corrected and marked in special journal entries.

HighRadius Autonomous Finance Platform

Obviously, automating this process is a surefire way to execute reconciliations on a daily or even weekly basis because it will be a time-consuming process otherwise. While it is possible and somewhat common to have discrepancies within your accounts, some will be easily explainable and others will require some investigation. No matter the reason for discrepancies, the main purpose of account reconciliation is to rectify these differences so that you can move forward with confidence in your account balances. Regardless of the size of your organisation, you’re likely to be conducting account reconciliations on a consistent basis. This important process can be made easy with the aid of automation solutions.

When accounting teams reconcile their customers’ accounts, they must take extra precautions to reduce the likelihood of making mistakes. Furthermore, reconciliation may need the participation of a professional to record transactions that may have been recorded improperly, were left out or were the result of mistakes made by the bank. For instance, a company can utilize different accounting software systems to manage sales and inventory, resulting in specific disparities between the two accounts.

Find and add cash deposits and account credits that appear in the cash book but not on the bank statement to the bank statement balance. Alternatively, if there are deposits on the bank statement but nothing in the cash book, add them to the cash book balance. The transactions should be deducted from the balance on the bank statement. Transactions on the bank statement but not in the cash book should also be noted. ATM service fees and check printing fees may be among the transactions affected—overdrafts, unpaid checks, etc. The reconciliation of accounts is one of the more typical types of reconciliation.

Access the internal source of data being reviewed (i.e. the bank ledger account on your accounting software) and compare it against the external document it is being compared against (i.e. bank statement). Confirm that the opening balance on the former agrees to the closing balance on the latter. The reconciliation has been successful if the same balance appears in the accounts of both companies, with it being a debtor in one company’s books and a creditor in the other’s. This, in essence, ensures that the consolidated accounts eliminate any artificial profit/loss from intercompany transactions. As CEO and Co-Founder, Mike leads FloQast’s corporate vision, strategy and execution. Prior to founding FloQast, he managed the accounting team at Cornerstone OnDemand, a SaaS company in Los Angeles.

How Does Account Reconciliation Work?

When large discrepancies are discovered, the company may find that they’re due to theft. Data sources used to remediate and reconcile account balances include sub-ledgers for HR and fixed assets, bank statements and accounts receivable and payable schedules. For both internal and external sources, every balance must match its corresponding account in the GL.

Companies often undertake balance sheet reconciliations each month after the previous month’s books are closed. Once all differences have been identified and adjusted, it is necessary to reconcile cash balance shown on the internal records with those on the bank statement by summarizing all transactions that occurred during the period. A bank error is an incorrect debit or credit on the bank statement of a check or deposit recorded in the wrong account. Bank errors are infrequent, but the company should contact the bank immediately to report the errors. The correction will appear in the future bank statement, but an adjustment is required in the current period’s bank reconciliation to reconcile the discrepancy. Reconciling an account is an accounting process that is used to ensure that the transactions in a company’s financial records are consistent with independent third party reports.

These values tend to be reported separately within annual accounts, so their accuracy is important for both internal and external purposes. Reconciling your accounts is not optional due to the necessity for all companies to file annual statements, summarising a year’s worth of transactions accurately. Companies which are audited will have the validity of their financial statements put under greater scrutiny due to the audit process, testing whether they are accurate and free from material misstatement. Alternatively, businesses with a field sales team will have to reconcile the value of employee expenses payable with the individual balances of submitted expense reports. There is more likely to be difference when reconciling if part of the expenses process is performed manually. Historically, reconciliation accounting was a relatively manual process, with the reconciliations themselves taking place in an Excel spreadsheet or on physical pieces of paper.

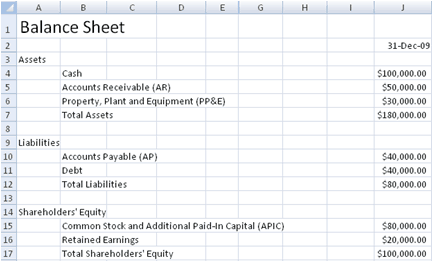

While account reconciliation is useful for your business to know where it stands financially, which, in turn, will affect important decisions, it also can impact your organisation’s risk. This is especially true for publicly traded companies, which must share their internal control mechanisms with their annual reports (as part of the Sarbanes-Oxley Act). The very basis of double-entry accounting is itself an internal reconciliation. Transactions that impact a company’s bottom line — net income — are split between accounts on the balance sheet and the income statement.

This allows the company to verify its checking account balance more frequently and to make any necessary corrections much sooner. In accounting, a company’s cash includes the money in its checking account(s). To safeguard this critical and tempting asset, a company should establish internal controls over its cash. The bank reconciliation—or cash reconciliation—is the similarly time-consuming process of reconciling transactions when they exist in your general ledger but not your bank’s reporting systems or vice versa. For example, a check is cashed at the bank before the corresponding journal entry is made in your accounting software. A bank inaccuracy is an inaccurate debit or credit on a bank statement resulting from a cheque or deposit is recorded in the incorrect account.

AutoRec leverages AI to reconcile transactions, whether those are one-to-one, one-to-many, or many-to-many. Unlike other reconciliation systems, AutoRec doesn’t require users to create or maintain rules. Plus, you can set accuracy thresholds to determine whether transactions need to match to the penny, or if being off by say 5% is close enough.

How to reconcile accounts

During the year-end financial close, the books may be left open for a brief period of time so that account reconciliations for major accounts can be performed and adjustments are included in the final balances before closing. Any differences are investigated, and corrective action is taken when appropriate. Account reconciliation is an effective internal control for keeping a company’s GL account balances accurate. In turn, this process increases the accuracy of financial statements and analyses — which are based on the GL and are used by internal decision-makers and external stakeholders. In addition, regular reconciliations to outside information can uncover fraud and anomalies. For example, an account reconciliation for inventory compares the GL account balance of the items believed to be held in inventory to an actual physical count of warehouse stock.

Customer Reconciliation

Consequently, employees have less time in the day for other vital activities such as financial planning. One of the challenges of a manual reconciliation process is accountability. With no automation around workflow and no reportability of status, it’s difficult to ensure policies are adhered to and work is being completed timely by the appropriate resources.

In the past, reconciliation was only performed manually through the use of Excel spreadsheets. Now, businesses can reap the advantages of automation solutions like SolveXia, which can perform account reconciliations and save you time. Each step of data processing, including downloading, uploading, checking for consistency in files, and record matching, has a chance of error. For example, you could download or upload an outdated file or reconcile the wrong accounts. As a result, you might overestimate your cash flow and cause an increase in the cost of future corrections.

If they are not performed, the probability that an auditor will find errors will increase, which could trigger a judgment that a business has a material control weakness. The most daunting reason for account differences may be attributed to fraud. By performing reconciliations regularly, you’ll be able to spot fraud and thievery early on, which makes it easier to rectify Direct Costs & Indirect Costs: Complete Guide + Examples and stop from becoming an even bigger issue. It could be the case that a transaction hit the wrong account or was manually entered incorrectly so there’s a typo in the amount. Accountants are freed from worrying about incomplete or messy reconciliations and can instead focus on the high-risk accounts, analysis, and adding strategic value to the organization.

Without performing balance sheet reconciliations, it’s very easy and likely that you will misinterpret your business’ cash position. This could result in business decisions that are not feasible or too risky given your current financial standing. Balance sheet reconciliations also offer insight and transparency into a business’ inner workings and where money is being spent. For example, a company may have to reconcile their inventory value on the balance sheet by manually counting stock of goods held. Or, for businesses in the financial services sector, there’s the need for frequent reconciliations of accounts of client held funds.